4:00

3

min at reading ▪

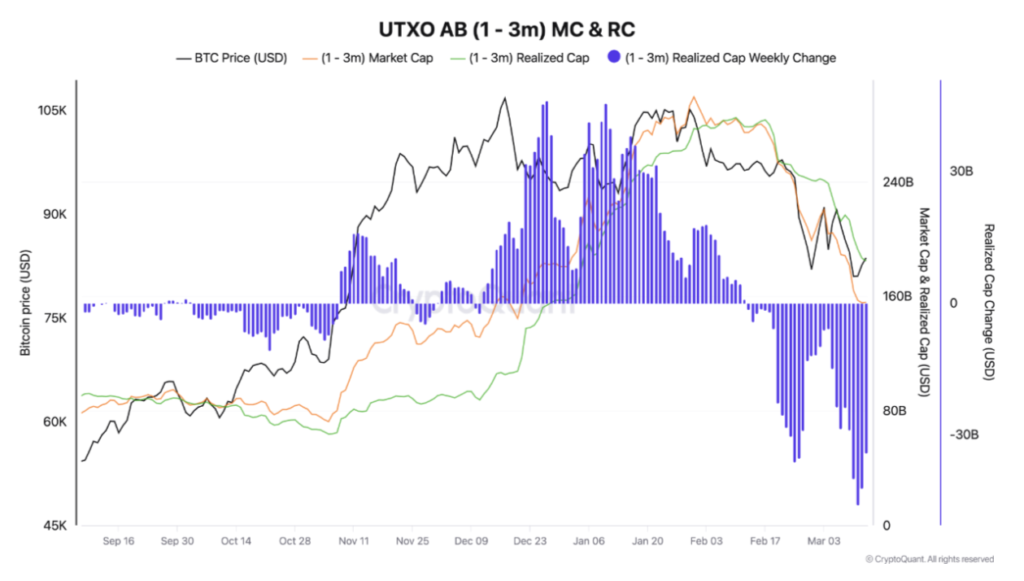

The panic wind blows on the Bitcoins market. In six weeks, short -term investors lost more than $ 100 million, imprisoned in brutal correction. Should we see a worrying signal or an opportunity masked for wise investors?

Bitcoin investors imprisoned in volatility

Since its historical summit in January, Bitcoin has fallen by 30 %, forcing many recent investors to dispose of their positions in panic. According to cryptocurrency data, BTC holders are those with the greatest losses for 1 to 3 months.

This phenomenon follows classic dynamics: at the time of the rise, speculators flock to quick profits. When the trend is perverted, the least experienced sells in panic, leading to this loss of more than $ 100 million. The chain indicators confirm the sale at least massive, which worsens the current correction and emphasis on market instability.

Baleins in reserve: discrete accumulation

If little investors leave their positions, big players on the market see the situation differently. Unlike short -term speculators, these long -term holders and institutions seem to use this decline to strengthen their portfolios.

The data on the string then shows an accumulation of around $ 80,000, suggesting that some see the opportunity rather than the signal down. This redistribution of active ingredients from weak hands to thick hands is a recurrent scheme, observed during each brutal correction of bitcoins in previous bull cycles.

Can the bitcoin market bounce?

The uncertainty remains: is this repair a turn or simple bull? Bitcoin has already undergone a decline from 30 to 40 % before departure. Analysts monitor key levels, including $ 70,000 support. However, macroeconomics and regulations can still consider the BTC trajectory.

Investors therefore apply their precipitation, while long -term investors accumulate. The psychology of the market affects these repairs, but the chain data indicates possible stabilization. For informed analysts, this autumn could be an opportunity to buy rather than alarm, confirming the market resistance.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.